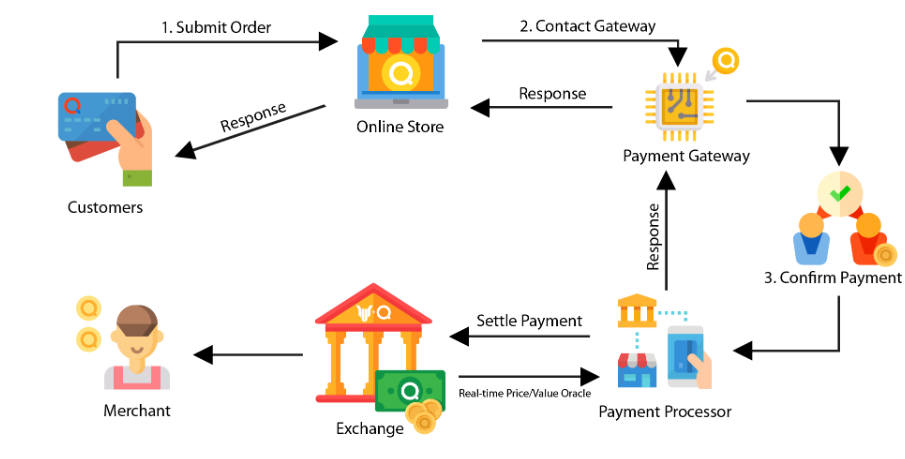

A payment gateway facilitates the transfer of information between a payment portal (such as a website or IVR service) and the Front End Processor or acquiring bank; quickly and securely.

When a customer orders a product from a payment gateway enabled merchant, the payment gateway performs a variety of tasks to process the transaction; completely invisible to the customer.

A customer places order on website by pressing the ‘Submit Order’ or equivalent button, or perhaps enters their card details using an automatic phone answering service.

If the order is via a website, the customer’s web browser encrypts the information to be sent between the browser and the merchant’s webserver. This is done via SSL (Secure Socket Layer) encryption.

The merchant then forwards the transaction details to their payment gateway. This is another SSL encrypted connection to the payment server hosted by the payment gateway.

The payment gateway which receives the transaction information from the merchant forwards it to the processor used by the merchant’s acquiring bank.

The processor forwards the transaction information to the card association (i.e., Visa/MasterCard)

If an American Express or Discover Card was used, then they act as the acquiring bank and directly provide a response of approved or declined to the payment gateway.

The card association routes the transaction to the correct card issuing bank.

The credit card issuing bank receives the authorization request and sends a response back to the payment gateway (via the same process as the request for authorization) with a response code. In addition to determining the fate of the payment, (i.e. approved or declined) the response code is used to define the reason why the transaction failed (such as insufficient funds, or bank link not available)

The payment gateway receives the response, and forwards it on to the website (or whatever interface was used to process the payment) where it is interpreted and a relevant response then relayed back to the cardholder and the merchant.

The entire process typically takes 2-3 seconds

The merchant must then ship the product prior being allowed to request to settle the transaction.

The merchant submits all their approved authorizations, in a “batch”, to their acquiring bank for settlement.

The acquiring bank deposits the total of the approved funds in to the merchant’s nominated account. This could be an account with the acquiring bank if the merchant does their banking with the same bank, or an account with another bank.

The entire process from authorization to settlement to funding typically takes 3 days.

Many payment gateways also provide tools to automatically screen orders for fraud and calculate tax in real time prior to the authorization request being sent to the processor. This is done by the gateway prior to the authorization request being sent to the processor. Tools to detect fraud include geolocation, velocity pattern analysis, delivery address verification, computer finger printing technology, identity morphing detection, and basic AVS checks.

See also